About

Corporate

Profile

| Corporate name | Energy & Environment Investment, Inc. |

|---|---|

| Representative | Shuichiro Kawamura, President |

| Location | 5-11-1 Higashigotanda, Shinagawa-ku, Tokyo, 141-0022 |

| Date of foundation | March 3, 2006 |

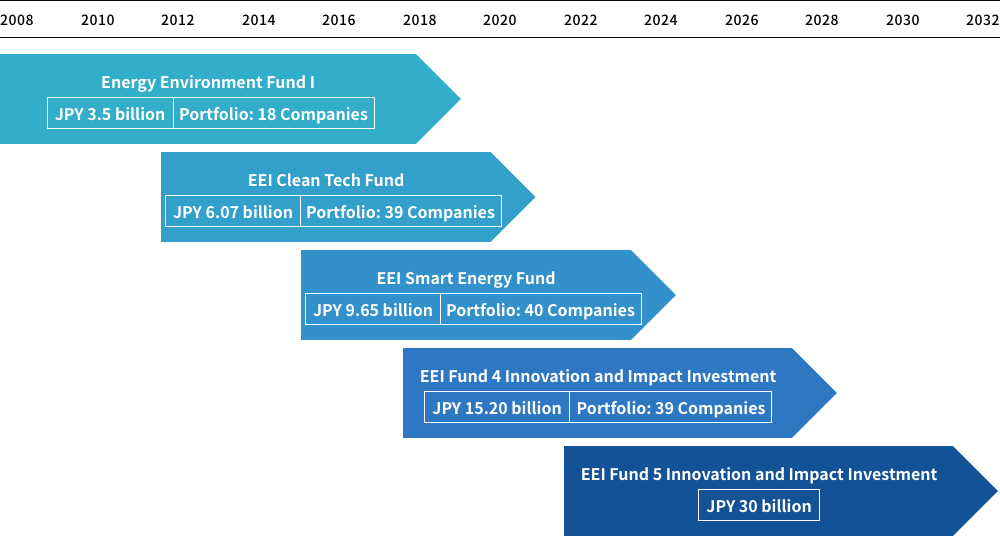

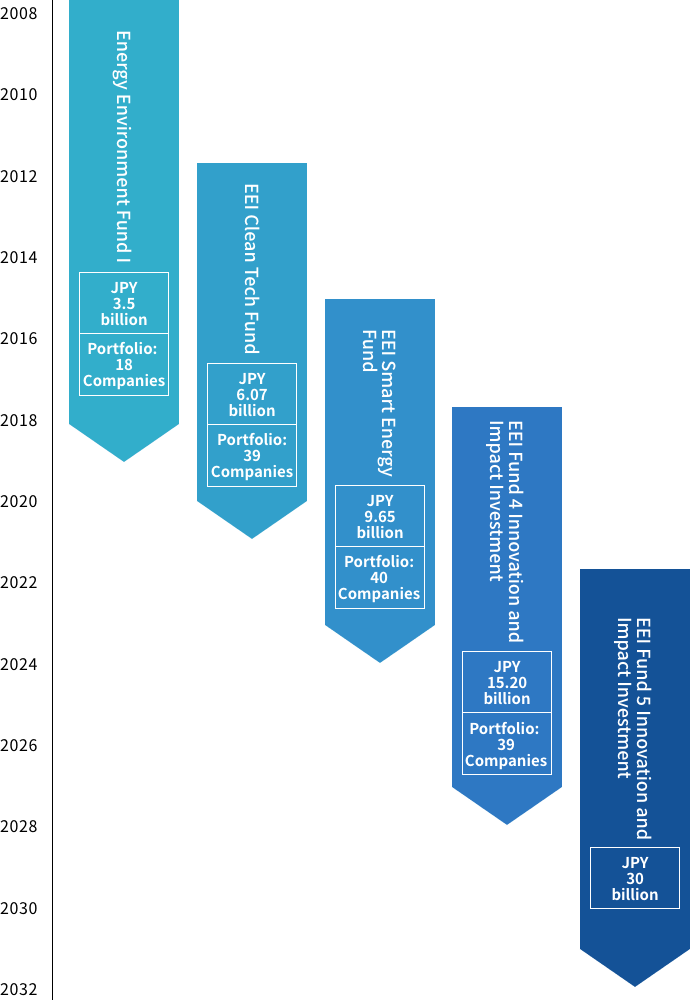

Funds Managed – Overview

Fund V & Fund IV – Overview

| Name | EEI Fund 5 Innovation and Impact Investment |

|---|---|

| Fund size | JPY 30 billion |

| Fund duration | September 15, 2022 to December 31, 2032 (the duration may be extended up to two years) |

| Main investment sectors |

Startups with innovative business models and technologies that contribute to addressing environmental and social issues with a focus on decarbonization

|

Excerpts of LP investors | Financial institution Corporation State fund |

| Name | EEI Fund 4 Innovation and Impact Investment |

|---|---|

| Target fund size | JPY 15.20 billion |

| Fund duration | June 20, 2018 to June 19, 2028 (the duration may be extended up to two years) |

| Main investment sectors |

|

Excerpts of LP investors | Financial institution Corporation State fund |

SDGs/ESG Investment

As in our mission of achieving sustainability through innovation and entrepreneurship, we invest in start-ups that are driving innovation in the environment and energy sectors.

We focus our investments in the following three key areas of global environmental and social challenges.

- ・The structural transformation of energy industry to achieve a decarbonized society, which is urgently needed as environmental, economic, and social issues caused by climate change become more apparent.

- ・The innovation on decarbonization to reduce COS emissions and address social issues regarding mobility and transportation by promoting electric vehicles etc.

- ・The foundation of sustainable society through smarter and more flexible solutions to address social issues such as resource scarcity

We invest in and support the business growth of start-ups that can contribute to a sustainable society. We incorporates impact KPIs with reference to SDGs, in the investment criteria, as well as monitoring impact creation and ESG management and supporting strategy and business growth.We will strive to contribute to the realization of a sustainable society through our venture investments.